Ryu Muramatsu | Director / Founding Partner

Ryu Muramatsu is a co-founder and Executive Vice President of GMO Payment Gateway Inc and a Founding Partner and Director of GMO VenturePartners. GMO Payment Gateway is the largest online payment service provider in Japan, public since 2005. Currently, he resides in Singapore to focus on Asian market. Prior to founding his first payment startup, Ryu worked for JAFCO, the largest VC in Japan and JAFCO Ventures in Silicon Valley. He was in charge of Business Development and Japanese connection of its US based portfolio companies. As an investor and entrepreneur, it's 100 portfolio companies include 22 IPOs and 12 billion dollar companies at maximum. (GMO Internet Group, Inc., GMO Payment Gateway Inc., Qihoo 360 Technology Co. Ltd.,LIFULL Co., Ltd.,Mercari,Inc.,VECTOR INC.,MoneyForward,Inc.,Uzabase, Inc., RAKSUL INC.,Sansan,Inc., GMO Financial Holdings, Inc.,Razorpay,Inc.) Ryu earned his B.A. degree from Waseda University.

Kazuyasu Sugiyama | Rep. Director

Kazu was in charge of fund raising, management and legal at Softbank Investment(Currently SBI Investment) and Nippon Venture Capital. Also at Nippon Venture Capital he was a head of venture capital fund raising and managment business. Through, the business he was involved in various numbers of fund raising and management including GMO VenturePartneres. Kazu became representive director of GMO VenturePartners at October of 2016. He earned his B.A from Hitotsubashi University.

Kota Uno |Principal

In 2009, Kota joined ABeam M&A Consulting and engaged in business due diligence and value-up plan construction after investment. After that, I have charge of a marketing project of a pharmaceutical company at M3, Inc which operates a portal site for medical staff. I work for this fund from 2017. Master of Engineering, Hokkaido University.

Shintaro Kawano | Value-Up Specialist

Shintaro joined Slogan, Inc. at its early stage in 2009 and engaged venture company and startups hiring support. He served as the Head of Sales, Head Office Executive Officer and Group Company Director. In 2017, he went on loan to REAPRA Ventures, a Singapore-related VC, and participated in the launch of Tokyo office as HR Manager. He returned to Slogan, Inc. in 2018. Since 2020, he works in domestic investment execution / support at GMO VenturePartners. Graduated the faculty of Law of Meiji University.

Hiroyuki Tsuda |Business Development/Principal

Hiroyuki joined GMO VenturePartners in 2021 as a Principal, focusing on business development. He provides hands-on business supports to portfolio companies. In 2022, he led the fundraising for the latest fund, “GMO Fintech Fund 7 LP”. He is also responsible for coordinating business collaborations among start-ups and fund investors.

Prior to his current position, he worked for Sumitomo Corporation, a global trading and investment company, where he led large ticket mergers and acquisitions, business restructuring, and managed group companies in the leasing, aviation, and social infrastructure sectors. He was stationed in London and New York, where he served as the head of Corporate Planning Department at Sumitomo Corporation of Americas, responsible for planning and executing corporate strategies throughout the Americas, including Canada, the US, Mexico, and South American countries. He holds BA from Hitotsubashi University.

Yuta Yamamoto | Principal / Head of Global Investment

Yuta joined GMO VenturePartners in 2018 with a focus on global investments in the US, Europe, SEA, and India, where he helps support current and future portfolio companies. Prior to the current position, he worked at Hardware Club, a French venture capital where he handled its Japan operation, participated in its first fundraising and evaluated international investment opportunities. He started his career in the Real Estate and Hotel Management department at Japan Post Holdings. Yuta holds MBA from HEC Paris and BA from The University of Tokyo.

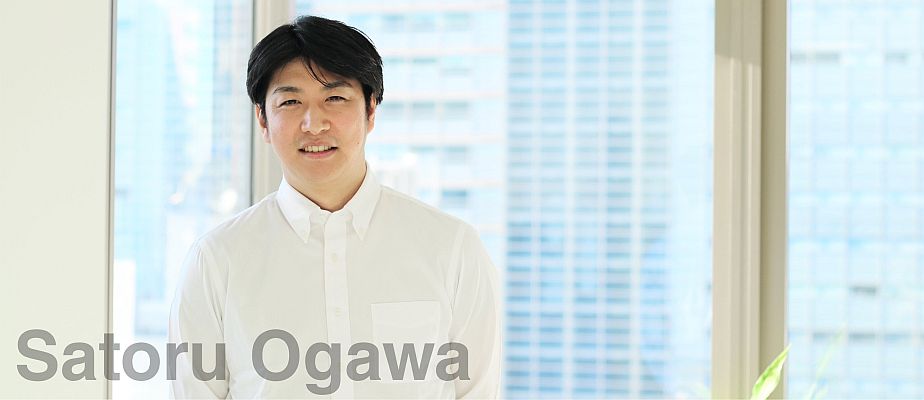

Satoru Ogawa | Senior Analyst

Satoru joined GMO VenturePartners in 2022 and has been investing in startups in India, Southeast Asia, and the US. Prior to GMO VenturePartners, he worked at Goldman Sachs as a lead analyst in the precision technology and semiconductor production equipment sectors of Japanese equities, where he was involved in research on listed companies and marketing to global institutional investors. He holds BA from Keio University.